Commentary – Third Quarter 2023

November 28, 2023

Commentary – First Quarter 2024

June 27, 2024

Commentary – Third Quarter 2023

November 28, 2023

Commentary – First Quarter 2024

June 27, 2024INSIGHTS

Commentary - Fourth Quarter 2023

The economic landscape can feel like a stormy sea, with waves of inflation, shifting interest rates, and geopolitical currents threatening to overwhelm even the most seasoned investor. But within this complexity lies opportunity.

Our Quarterly Recap & Market Outlook provides insight into the forces shaping the market in 2024, beyond the headlines and noise. Connect with us at info@eamoncap.com and take control of your financial future.

QUARTERLY RECAP

Macroeconomic

Economic Growth (as illustrated by GDP)

The GDP growth rate has normalized compared to previous quarters, now trending in the 2.0%-4.0% range, declining from the high single digits seen in 2020 and 2021.

As we closed out the year, economic growth remained robust, with GDP (Gross Domestic Product) increasing at a rate of +4.9% during the third quarter, up from +2.1% in the second quarter. Consumer spending rebounded, contributing +3.6% more this quarter compared to last quarter.

Fiscal spending showed no sign of moderating, with federal spending as a percentage of GDP up +7.7% from the second quarter. Since the pandemic, federal spending has not waned on any level. The deficit for 2023 stood at a staggering $1.7 trillion, up nearly $45 billion from the same period in 2022.

To end the year, fourth quarter GDP was up +3.3% and was another blowout quarter defying consensus expectations. The increase was driven by consumer and government spending along with corporate inventory investment.

Overall, U.S. economic growth should remain at a moderate, albeit slowing, pace from here. A slower-moving economy will be increasingly sensitive to shocks from variables like the U.S. election, higher policy rates, geopolitical tension or something else entirely. Multiple risks still remain that could push the economy into recession in 2024.

Inflation

Inflation data provided conflicting signals while still trending downward. Consumer prices edged up +0.1% in November and stood +3.1% higher year-over-year. December inflation numbers were largely unchanged at +3.4% to the previous print but still above the Fed's 2.0% target.

Core inflation, a more relevant gauge in the eyes of the Fed, as it excludes food and energy, has shown a disinflationary trend. It came in at a +3.9% annual rate through December, down from +5.7% a year earlier. A significant drop in oil prices led to headline inflation dropping more than core inflation, hence the higher core inflation number. Again, this still remains elevated versus the Fed’s 2.0% target.

Labor Market

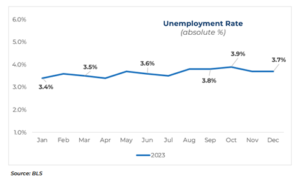

Job growth appeared to moderate slightly in November, with a gain in nonfarm payrolls of 199,000 jobs, and a similar number in December of 216,000 jobs. This is below the average monthly gain of 240,000 we have seen in the past 12 months. However, this figure does take into account striking workers (auto and entertainment industry) returning to their jobs. The highest job growth was in the healthcare and government sectors. Wage growth was also strong, with hourly earnings up +4% year over year.

These numbers point to a resilient labor market with unemployment holding steady at 3.7% to end the year. Despite this, we are seeing slowing job growth, with consecutive downward revisions from previous reports, and signs of upward wage pressures easing. The number of long-term unemployed (those jobless for 27 weeks or more) stood at 1.2 million and was unchanged in December and over the year.

Geopolitical Landscape

Risks from a geopolitical perspective have played a big role in markets over the past several years with 2024 expected to be no different. The continued war in Eastern Europe and the developing conflict in the Middle East have many uneasy about the global economic outlook.

Investors have reason for concern as shipping costs have spiked more than 100% since October in the wake of attacks by Houthi rebels in the Red Sea. This led to perceptions of oil supply disruptions pushing the price of Brent crude oil above $80/barrel before settling back towards $70s/barrel.

Markets

The stock market ended up significantly after a post October rally. Buoyed by Artificial Intelligence (AI) exuberance and the stunning outperformance of the “Magnificent Seven” technology stocks, the S&P 500 Index delivered a +11.7% return on the quarter and +26.3% on the year.

Bonds started the quarter in the red then quickly reversed course, delivering +6.8% for the quarter and +5.5% for the year. This stemmed from a rapid decline in the yield curve following the Fed meeting in early November.

Equities

Despite the headlines indicating a strong rally for stocks in 2023, we question whether or not it was an actual rally. We would argue it was a reset to the levels seen before the Fed hiking cycle began in 2022.

Focusing solely on 2023, on a broader level, large-caps were the clear winner, as shown by the S&P 500 Index +26.3%, the Dow Jones Industrial Average +16.2% (an index containing limited technology representation), and the Russell 1000 Index +26.5%. Mid-caps and small-caps posted strong returns but lagged its larger counterparts as shown by the Russell Mid Cap Index +17.2% and Russell Small Cap Index +16.9%. International stocks underperformed their U.S counterparts when looking at the MSCI EAFE Index +18.2% and the MSCI Emerging Markets Index +9.8%.

From a style standpoint, growth stocks outperformed value stocks across the board with the exception of international stocks where value outperformed growth by a small margin.

Bonds

The asset class saw a rough start to 2023 and set it on a path for a third consecutive year of negative returns. This would have been something never experienced before in the history of the bond market (since 1976).

Overall for 2023, higher quality bond performance lagged, by a significant margin, lower quality and non-U.S. bonds. This can be seen by the difference in performance between the higher quality Bloomberg U.S. Intermediate Corporate Index +6.9% relative to the below investment-grade ICE BofA U.S. High Yield Index +13.5% for the year.

Outlook

As Fed activity continues to be at the forefront, all eyes are on its next move. As the Federal Open Market Committee (“FOMC”), the part of the Fed responsible for manipulating interest rates, shifts from a tightening posture to more of an accommodative posture, the focus has turned to the timing of its first rate cut in 2024. In addition, we are grappling with the potential impact from the upcoming U.S. election also in 2024.

Looking Ahead & Positioning

Want to uncover the complete picture of how the market might unfold in 2024?

Our exclusive newsletter delves into more than just current trends. You'll discover:

Our in-depth market outlook: Uncover the forces shaping the coming months and their potential impact on your portfolio.

Expert portfolio positioning: See how we strategically adjust portfolios to capture opportunities amidst shifting market conditions.

Actionable insights: Gain tailored guidance to navigate challenges and capitalize on potential upsides.

Simply connect with us at info@eamoncap.com and take control of your financial future.

Eamon Capital Management, LLC (“Eamon”) is a registered investment advisor offering advisory services in the State of Pennsylvania and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Eamon Capital Management, LLC (referred to as “Eamon”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute Eamon’s judgement as of the date of this communication and are subject to change without notice. Eamon does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall Eamon be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if Eamon or a Eamon authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.