Commentary – Third Quarter 2024

November 18, 2024

Commentary – First Quarter 2025

March 21, 2025

Commentary – Third Quarter 2024

November 18, 2024

Commentary – First Quarter 2025

March 21, 2025INSIGHTS

Commentary - Fourth Quarter 2024

Against the Grindstone - Battling Major Economic Headwinds

Our Quarterly Recap & Market Outlook provides insight into the forces shaping the market – beyond the headlines and noise. Connect with us at info@eamoncap.com and take control of your financial future.

QUARTERLY RECAP

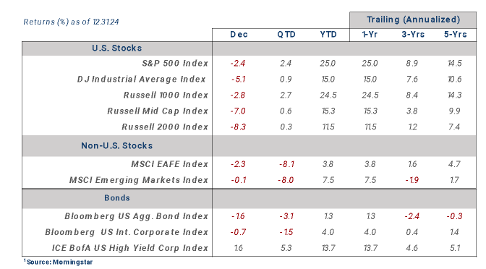

In the final quarter of 2024, the U.S. markets experienced a mixed bag of performance. The S&P 500 rose by +2.4%, driven again by technology stocks, while small-cap stocks remained nearly flat. Persistent inflation and uncertainty around the trend in general interest rates contributed to market volatility.

The bond market saw over a -3.0% decline as the Federal Reserve signaled a pause in rate cuts and market sentiment shifted to concerns around the Trump administration’s tariff policies.

Despite these challenges, the U.S. economy grew by +2.3% in Q4, down from +3.2% in Q3. The labor market showed signs of stabilization, with the unemployment rate ending the year at 4.1%. Overall, the U.S. markets finished strong, with the S&P 500 Index up over +20% for the second year in a row.

Macro-Economic Recap

GDP

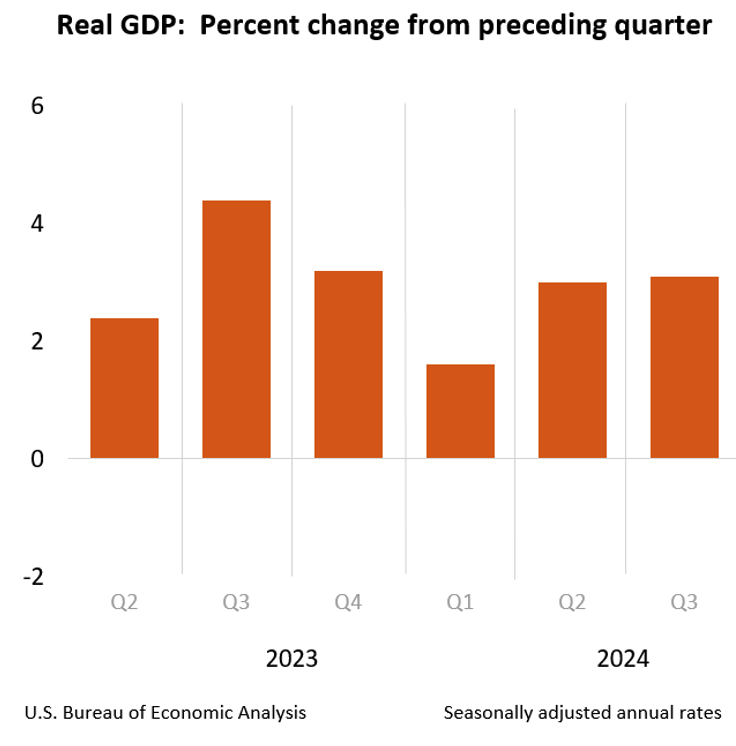

In the second half of the year, the U.S. economy experienced an uptick in GDP. The third quarter saw a modest increase of +3.2%, up from +3.0% in the second quarter and double that of the first quarter at +1.6%. The growth increases were attributed to strong consumer spending, business investment, federal government and infrastructure spending and an increase in global exports from the U.S.

For the fourth quarter, the GDPNow model estimate was flat to the third quarter at +3.2%. However, when the dust settled, the fourth quarter came in below expectations at +2.3%. As seen in past quarters, consumer and government spending were the main contributors while the major detractors were declines in business investment, imports, and exports.

Overall, the U.S. GDP growth for the second half of 2024 was a mixed picture, reflecting both the headwinds from monetary policy tightening and the underlying strength in certain parts of the economy.

Inflation

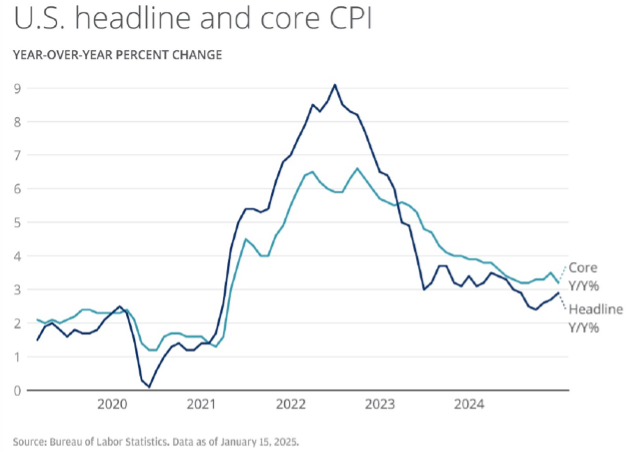

U.S. inflation showed signs of easing but remained above the Federal Reserve's target. The Consumer Price Index (CPI) rose by +2.9% for the year, with a notable increase of +0.4% in December. Core inflation, which excludes food and energy prices, stood at +3.3% year-over-year as of December. This was slightly lower than the +3.4% seen in the previous month and below market expectations.

The Federal Reserve's restrictive stance for policy interest rates has helped tame inflation while fiscal deficit spending has proved to be a tailwind for economic growth and sustained inflationary pressures. Overall, while inflation has decreased from the peaks seen in 2022 and 2023, it has remained a challenge for policymakers aiming to achieve price stability.

Labor Market

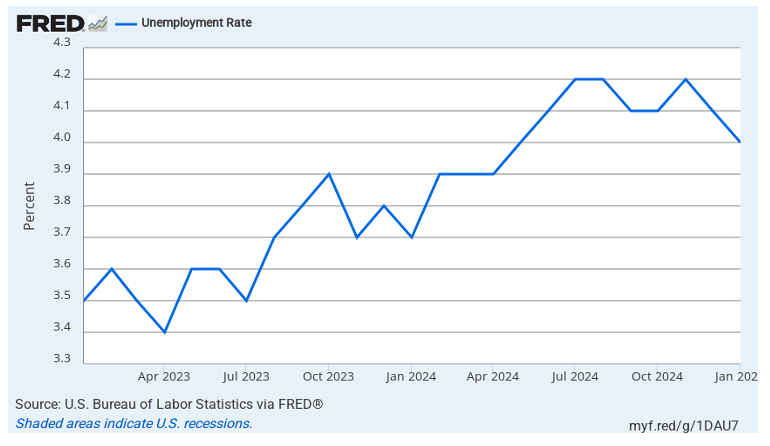

The U.S. labor market demonstrated unexpected strength, seemingly defying earlier signs of a slowdown. The unemployment rate decreased slightly to 4.1% in December, down from 4.2% in November. The economy added 256,000 jobs in December, surpassing expectations and marking the largest increase since March 2024. This robust job growth brought the total number of jobs created in 2024 to 2.2 million.

Despite this positive trend, there were signs of cooling in the labor market. Job openings declined, reaching a three-year low, and temporary employment saw a downward trend. Wage growth remained steady at around 3.9% year-over-year, indicating a balance between labor supply and demand.

Sectoral performance varied, with healthcare, government, and retail trade showing significant job gains, while manufacturing experienced a decline. The labor market's resilience has contributed to a stronger-than-expected economic outlook, influencing the Federal Reserve's monetary policy decisions and keeping their rate cutting plans on hold.

Financial Markets Performance Recap

Stocks

For the quarter, despite a deep negative print for the month of December, all U.S. stock indices we track ended in positive territory. A post-election rally helped buoy the overall market while increased volatility related to Federal Reserve policy and the Trump administration’s economic and fiscal plans subdued overall performance.

Large cap trounced its mid cap and small cap counterparts as shown by the S&P 500 Index up +2.4% and Russell 1000 Index +2.7% relative to the Russell Mid Cap Index +0.6% and the Russell 2000 Index +0.3%. This was a reversal from the high single digit performance seen in both mid cap and small cap in the third quarter. Investor sentiment shifted to cautionary on these capitalizations due to uncertainty around a possible “higher for longer” interest rate scenario and its impact on the balance sheets of more highly levered companies. In line with the theme for 2024, the technology heavy Nasdaq 100 Index +4.9% outperformed its less tech heavy counterparts.

From a style perspective, growth outperformed value across all market capitalizations in the U.S. while value outperformed growth abroad. The largest disparity was in mid cap at +9.8% (Russell Mid Cap Growth Index +8.1% vs. Russell Mid Cap Value Index -1.7%) followed by large cap at +9.1% (Russell 1000 Growth Index +7.1% vs Russell 1000 Value Index -2.0%). It was barely noticeable in small cap at +2.8% (Russell 2000 Growth Index +1.7% vs Russell 2000 Value Index -1.1%).

Outside of the U.S., performance was solidly in the red as two rate cuts by the European Central Bank added to market volatility and bolstered the U.S. dollar. The higher quality MSCI EAFE Index was down -8.1% while the MSCI Emerging Markets Index performed in similar fashion finishing down -8.0%.

Bonds

For the last quarter of the year, the Treasury market took a bit of a roller coaster ride. After a strong summer rally, things changed dramatically by year-end, causing yields to go up significantly. Even though the Federal Reserve cut interest rates twice, bringing the target range to 4.25%–4.50%, intermediate maturity (5s and 10s) Treasury notes saw a sell-off. On the bright side, credit spreads were generally tighter and remained below long-term averages.

From October to December, the gap on investment-grade corporate bonds narrowed by nine basis points, while high-yield bonds closed the gap by eight basis points. Emerging markets debt led the way, tightening by 77 basis points. Credit spreads decreasing will contribute to positive performance while credit spreads increasing will detract from performance.

During this time, the 10-year Treasury yield increased by 80 basis points, ending the quarter at 4.58%, and the 30-year Treasury bond yield went up by 66 basis points to 4.78%.

Despite the sell-off in the fourth quarter, most major fixed-income indexes still managed to post modest gains for the year. The Bloomberg Aggregate Bond Index fell by -3.1% in the fourth quarter but ended the year with a return of +1.3%. High-yield corporate bonds performed better, with the ICE BofA U.S. High Yield Corp Index gaining +0.2% in the fourth quarter and achieved a return of +8.2% for 2024.

Want to uncover the complete picture of how the market might unfold in 2024? Our exclusive newsletter delves into more than just current trends.

You'll discover:

Our in-depth market outlook: Uncover the forces shaping the coming months and their potential impact on your portfolio.

Expert portfolio positioning: See how we strategically adjust portfolios to capture opportunities amidst shifting market conditions.

Actionable insights: Gain tailored guidance to navigate challenges and capitalize on potential upsides.

Simply connect with us at info@eamoncap.com and take control of your financial future.

Eamon Capital Management, LLC (“Eamon”) is a registered investment advisor offering advisory services in the State of Pennsylvania and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Eamon Capital Management, LLC (referred to as “Eamon”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute Eamon’s judgement as of the date of this communication and are subject to change without notice. Eamon does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall Eamon be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if Eamon or a Eamon authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.