Commentary – Fourth Quarter 2023

February 21, 2024

Commentary – Second Quarter 2024

September 3, 2024

Commentary – Fourth Quarter 2023

February 21, 2024

Commentary – Second Quarter 2024

September 3, 2024INSIGHTS

Commentary - Fourth Quarter 2023

Does Slowing Growth Mean Recession Imminent? Maybe or Maybe Not...

Our Quarterly Recap & Market Outlook provides insight into the forces shaping the market in 2024, beyond the headlines and noise. Connect with us at info@eamoncap.com and take control of your financial future.

QUARTERLY RECAP

Building on the extreme positive momentum of 2023, U.S. stocks again were the top performer to end the first quarter. While performance was in the high single digits to low double-digit range, it was muted when compared to the major gains seen in 2023. Bonds continued to get whipsawed as markets attempt to triangulate the inflation trend, economic growth, and Federal Reserve sentiment for the future path of rates.

Macroeconomic

The Federal Reserve has hiked rates by a cumulative 5.25% since the beginning of 2022 to combat inflation. At the last five of its meetings, the FOMC voted to leave the policy rate unchanged from its current range of 5.25%-5.50%. And with the inflation trend slowing towards the 2% policy target, albeit in a lumpy fashion, and labor market conditions easing, the rate hike in July ‘23 was likely the last of this cycle. At the close of February, Fed Fund futures were pricing in a 60% probability of a 50 bp cut by June ‘24. Since then economic data has come in hotter than expected, pushing the market pricing for timing of the first rate cut well beyond the June ‘24 meeting.

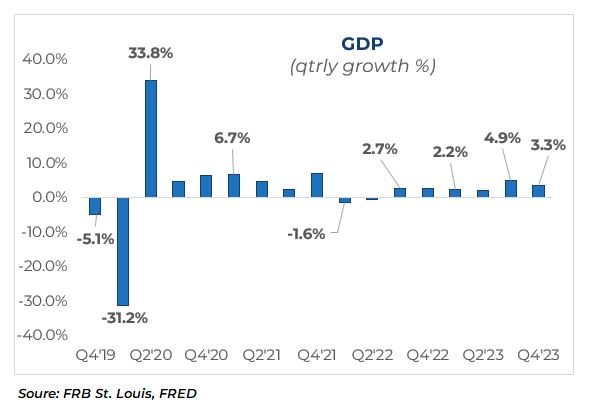

GDP

Up until now, consumers have remained resilient, supported by a tight labor market and rising real wages. However, revolving credit as a share of disposable income continues to grow to significant levels, with delinquencies rising and younger households showing signs of increased financial stress. While there are no imminent signs of overextension by consumers, it is definitely an indicator worth watching in the coming months.

The GDPNow model, a preliminary estimate of real GDP growth, estimates growth (a seasonally adjusted annual rate) in the first quarter of 2024 to be around 2.8 percent with it being revised lower to 2.4 percent at the start of April 2024 (source: Atlanta Fed).

Government spending was a large and positive contributor to growth in 2023 and was a result of infrastructure investment legislation passed in 2021 and 2022. But as this government contribution recedes growth is likely to slow in 2024 and 2025. Furthermore, political volatility surrounding fiscal policy and government debt levels could reduce government spending over the next few years. Overall, the U.S. economy should continue to grow at a moderate but slowing pace. All eyes will be on this data as it relates to the near-term outlook for U.S. stocks and other risk assets.

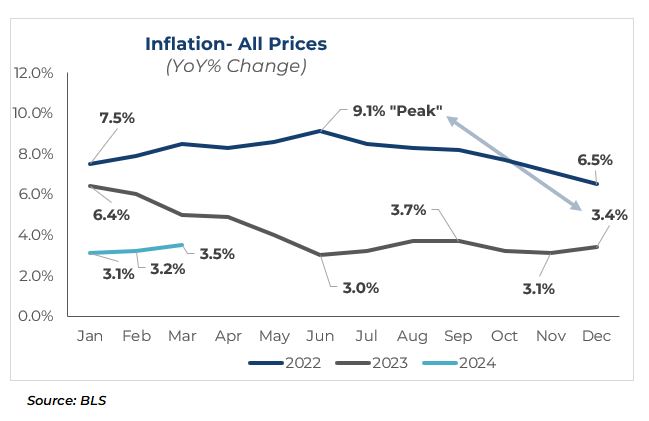

Inflation

After inflation reached 50-year highs in 2022, the inflation trend has been declining and is now about one-third of the +9.1% peak. We believe the trend will continue to move toward the long-term Fed policy goal of 2%. However, it is not expected to move in a straight line but rather pursue a lumpy path as seen in the in the first three months of 2024.

The Consumer Price Index (“CPI”), a broad measure of goods and services costs, was up +0.4% for the month and +3.2% from a year ago, as reported by the Labor Department’s Bureau of Labor Statistics (“BLS”). The monthly gain was in line with expectations with the annual rate being slightly ahead of the +3.1% consensus forecast from Dow Jones.

For March, the usual suspects drove prices higher including shelter (+0.5%), auto insurance (+2.6%), medical care (+0.5%), and apparel (+0.7%). Shelter was by far the biggest driver of the monthly CPI increase as it comprises about 40% of the overall basket of prices tracked by the BLS. For the last year, shelter was up +5.8% and contributed two-thirds of the overall core CPI increase over the period. On a more positive note, food prices increased at only a moderate pace of +0.1%, putting it at +2.2% for the year. Further, the largest decline in prices came from used cars and trucks -1.8% with it ending down -2.2% for the last year.

For the remainder of 2024, there are risks of the Fed cutting rates too early and reigniting the inflation trend higher once again. But it seems the Fed is cautious and is remaining disciplined to balance moderate inflation with low unemployment. It has communicated more than once it does not want to keep rates too high for too long and thus become overly restrictive on economic activity.

Labor Market

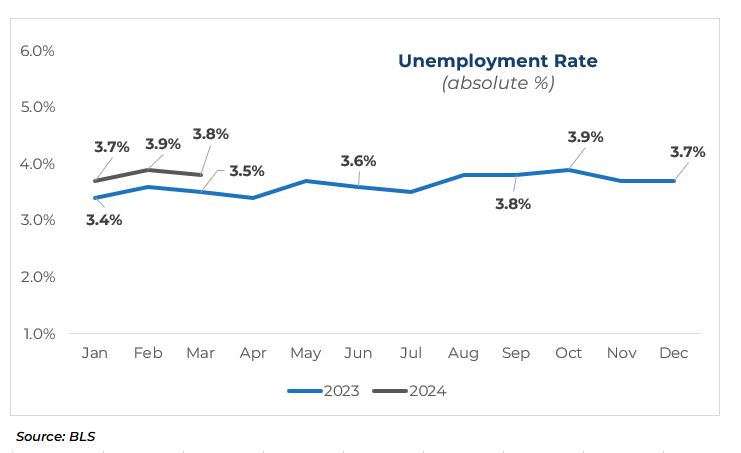

To start 2024, the U.S. labor market remained robust, signaling a resilient economy despite what many perceive as significant headwinds around higher for longer interest rate levels, inflation, and geopolitical risks.

The March nonfarm payroll report showed a significant increase in employment, with 303,000 jobs added, surpassing the average monthly gain of 231,000 over the previous year. This growth was primarily seen in health care, government, and construction sectors, reflecting a diverse expansion across various industries.

The unemployment rate in March stood at 3.8 percent, a slight decrease from the 3.9 percent observed in the previous month. This marginal decline continued to underscore the tightness of the labor market, with low unemployment rates suggesting strong job availability and steady economic momentum.

Wage growth also showed positive movement, with real average hourly earnings rising by +0.7 percent year-over-year as of March 2024. This increase in wages, coupled with a consistent average workweek, resulted in a similar +0.7% rise in real average weekly earnings over the same period. Wage growth is a critical factor as it influences consumer spending, which is a significant component of GDP.

The combination of substantial job creation, low unemployment, and moderate wage growth has had an unbalanced impact on the economy. On one hand, it has bolstered consumer confidence and spending, contributing to economic growth. On the other hand, these trends are inflationary which casts some doubt about the timing and amount of rate cuts by the Federal Reserve later this year.

Geopolitical Landscape

The significant geopolitical uncertainty in 2023 carried over to start 2024. The Gaza war, Russia’s invasion of Ukraine, and U.S.-China competition all weighed on investor sentiment. Amid heightened volatility and global fragility, investors have remained cautious on risk assets and favored higher quality stocks in the equity markets. Bonds were seen as a bright spot for investors given current yield levels, slowing growth, and continued disinflation. However, and somewhat concerning, most risk assets seemed to be pricing in a benign macro environment. This suggests investors might not have fully accounted for the potential impact of these geopolitical risks.

Markets

Equities

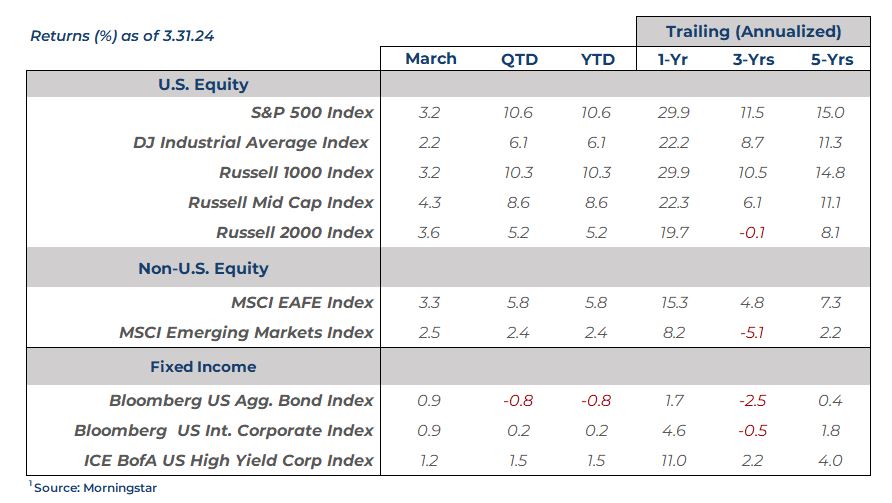

After the stellar rally seen in 2023, U.S. stocks moved higher during the first quarter. Large cap led the way as shown by the S&P 500 Index being up +10.6% followed by the Russell Mid Cap Index +8.6% and then by small caps as shown by the Russell 2000 Index +5.2%

There was certainly a divergence between styles as growth outperformed value across all market capitalizations. The biggest disparity was in small cap stocks with the Russell 2000 Growth Index +7.6% besting the Russell 2000 Value Index +2.9% by ~2.5x

Surprisingly, despite the significant headwinds of elevated interest rates, stubborn inflation and multiregional geopolitical risks, investors have gravitated toward the most speculative growth-oriented technology companies. The Nasdaq 100 Index, heavily weighted toward technology, has risen +36.4% over the last twelve months ending March 2024.

Internationally, performance was more varied and subdued on a relative basis. Developed markets, as shown by the MSCI EAFE Index, saw a gain of +5.8% during the quarter. Growth outperformed value similarly to its U.S. counterparts but in a smaller magnitude around ~1.5x. Emerging markets, on the other hand, experienced more muted returns lagging their developed market counterparts as shown by the MSCI Emerging Markets Index +2.4%. Emerging markets trailed due to geopolitical tensions, currency volatility, and a slower economic recovery compared to developed markets.

Bonds

Despite a surge in performance to end 2023, bonds were hit hard by interest rate volatility during the first quarter of 2024. This led to broader bond market performance struggling as shown by the Bloomberg Aggregate Index posting a -0.8% return.

Evolving expectations for the path of policy interest rates from the Fed caused rates to rise almost in lockstep across the maturity curve. The benchmark 10-year U.S. Treasury note was up +0.32% to yield 4.20% by quarter’s end. As a result, shorter maturity bonds outpaced longer maturity bonds given their lower sensitivity to interest rates.

However, investors continued to embrace risk assets, causing credit spreads to tighten and, in turn, aide overall corporate bond returns. Below-investment grade corporate bonds outperformed their higher quality counterparts as shown by the difference between the BofA U.S. High Yield Corp Index +1.5% and the Bloomberg U.S. Intermediate Credit Index +0.2%.

Alternatives & Real Assets

On a global scale, commercial real estate, one of the most widely followed alternative assets, showed some stability to start 2024. However, in the U.S. and North America, valuations remain under pressure as the sector is still distressed due to elevated financing rates and lower occupancy levels. The expectations for a major downturn in the sector have not abated with many eyeing 2024 and 2025 as an inflection point as many commercial real estate backed loans are due to mature over that period.

As for commodities, the macro landscape is rife with tailwinds for the sector. The Bloomberg Commodity Index (GSCI) rose +2.2% with energy, livestock and precious metals all being positive contributors while grains and industrial metals were detractors. Gold achieved all-time highs as market uncertainty led central banks to boost their holdings of the metal and push prices to record levels.

Outlook: Maintaining Positioning & Adjusting Expectations Around Timing

We are tweaking our outlook to account for new economic data since our last note without changing overall portfolio positioning. We still believe inflation will decline toward normalized levels around 2%, growth will slow in the U.S., and the Fed will cut interest rates to be more accommodative and less restrictive.

As with any economic forecast, short-term noise can present itself to overshadow a longer term investment thesis. As with this instance, the current deficit spending by the federal government (~$1.7 trillion in 2023) is proving to be a formidable force in keeping the U.S. economy on solid footing. It is bleeding through to increase consumer purchasing power, spurring corporate infrastructure investment, and buoying the labor market and real wage growth.

Unless we see major progress in the next couple of inflation and labor market data prints, it is our view the first interest rate cut will be pushed back to later in 2024 or even early 2025. But, we tread lightly as historically there is significant noise in the data reported in the early months of any calendar year- a result of spillover from elevated holiday spending. This was certainly the case in 2023 as inflation and labor market data spiked through March only to be on a down trend in the latter half of the year. We see this as a possibility thus far in 2024.

As we mentioned in our Q4'23 commentary, we increased exposure to stocks as it was clear we were firmly at the end of the interest rate hiking cycle by the Fed. See the snippet from our last note below (and corresponding chart):

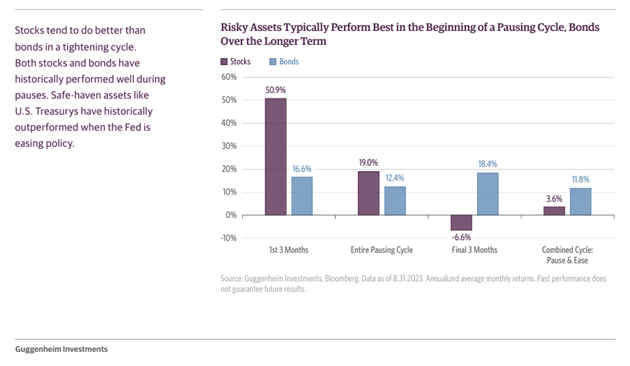

“From a market standpoint, historically when the FOMC pauses a hiking cycle, stocks tend to rally in the short-term and significantly outperform bonds. However, over the full length of a pausing cycle, i.e., no more interest rate hikes until the first interest rate cut, performance begins to balance between stocks and bonds. Further in the pausing cycle and into an easing cycle, stocks tend to underperform bonds. Given the last rate hike was in mid-2023, we are fully in the late-early to middle part of a pausing cycle and stocks are performing as expected.”

Looking Ahead & Positioning

Now, history does not always repeat but it often rhymes. Within the backdrop of the easing cycle performance in the chart above, we have increased our weight to stocks over the short-term (6-12 months) while keeping an eye on economic and geopolitical risks. We see the solid economic growth in 2023, continued declining inflation, and the strong, resilient labor market to be near-term catalysts for a continued rally in stocks. However, we will remain ready to pivot more defensively if indicators fall off sharply or point to a significant reversal in the health of the consumer or corporate fiscal landscape.

Further, we still maintain a healthy overweight to interest-rate duration, i.e., more interest-rate sensitive bonds, to benefit from an overall decline in interest rates as we await the Fed to start cutting rates in the not too distant future. The long-term forecast for their policy rate is around 3.0%- 3.25% and it currently stands in the 5.0%-5.25% range. We see this as an opportunistic trade generating returns well above stock returns over the next 12- 24 months with much less risk than stocks.

Want to uncover the complete picture of how the market might unfold in 2024?

Our exclusive newsletter delves into more than just current trends. You'll discover:

Our in-depth market outlook: Uncover the forces shaping the coming months and their potential impact on your portfolio.

Expert portfolio positioning: See how we strategically adjust portfolios to capture opportunities amidst shifting market conditions.

Actionable insights: Gain tailored guidance to navigate challenges and capitalize on potential upsides.

Simply connect with us at info@eamoncap.com and take control of your financial future.

Eamon Capital Management, LLC (“Eamon”) is a registered investment advisor offering advisory services in the State of Pennsylvania and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Eamon Capital Management, LLC (referred to as “Eamon”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute Eamon’s judgement as of the date of this communication and are subject to change without notice. Eamon does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall Eamon be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if Eamon or a Eamon authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.