Commentary – First Quarter 2022

May 26, 2022

Commentary – Second Quarter 2022

October 17, 2022

Commentary – First Quarter 2022

May 26, 2022

Commentary – Second Quarter 2022

October 17, 2022INSIGHTS

Staying the Course in Difficult Markets

If you have looked at your investment account or 401k recently, it might feel a little painful especially as of late. We wanted to share a couple of interesting statistics related to long-term market performance that might help alleviate the shock.

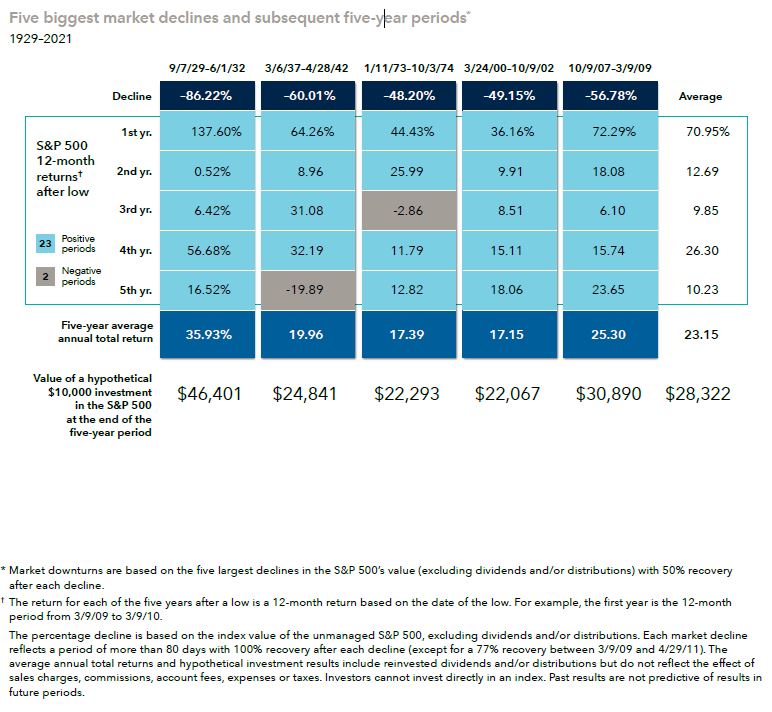

The Capital Group published recently a piece, “Keys to Prevailing Through Stock Market Declines” demonstrating the importance of staying fully invested in the face of the pain felt during market downturns.

Since 1951, the S&P 500 Index performance has shown (on average):

- Market declines of 5% or more happen about 3x per year and last 43 days

- Market declines of 20% or more happen about once every 6 years and last 370 days

Since 1929, of the five biggest declines (all greater than 45%) for the S&P 500 Index (on average):

- The first year following a major decline saw a return of close to 71%

- The third year following a major decline saw a return of close to 10%

- Over the five-year period following a market bottom returns averaged more than 23% on an annual basis

- A $10,000 investment at the market bottom ended the following five-year period with over $28,000

It is important to remain objective in the face of the market selloffs and volatility we have experienced so far in 2022. This begins with having a well crafted investment strategy, assuming market declines while accounting for a specific investor’s time horizon, to act as a roadmap for navigating these periods of market stress. Stay disciplined.

Eamon Capital Management, LLC (“Eamon”) is a registered investment advisor offering advisory services in the State of Pennsylvania and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Eamon Capital Management, LLC (referred to as “Eamon”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute Eamon’s judgement as of the date of this communication and are subject to change without notice. Eamon does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall Eamon be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if Eamon or a Eamon authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.